This ASB Financing technique is suitable for those who want maximum ASB Financing of RM 200,000. However, they don’t have enough savings to pay the instalments in the first year and want to pay monthly instalments at a low rate.

Perlu diingatkan bahawa teknik ini ada melibatkan penggunaan wang pinjaman peribadi. Therefore, before you decide to use this technique, make sure the interest rate charged on your personal loan is low. This technique is suitable for civil servants because the personal loan interest rates offered are very low compared to private sector employees. Let’s follow this technique.

Step 1: Apply for a Personal Loan

For example, Aidil is an employee earning RM 5000 per month. He wants to make ASB Financing of RM 200,000 and use this ASB Financing technique.

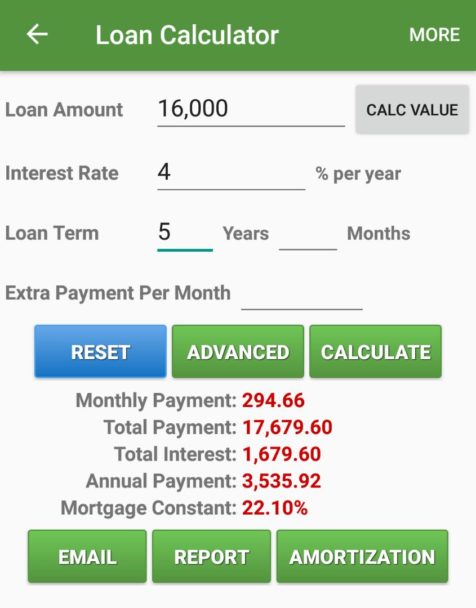

However, he doesn’t have enough cash savings to pay dividends in the first year. Therefore, Aidil takes out a personal loan of RM 16,000 with an interest rate of 4% per annum for a period of 5 years. The monthly instalment to be paid is RM 294.66 (refer to the image below).

Step 2: Apply for ASB Financing

Then, Aidil applies for ASB Financing of RM 200,000 with an interest rate of 5.3% per annum for a period of 30 years. The monthly instalment to be paid is RM 1,110.61. The total monthly instalments for the first year period is RM 13,327.32.

Aidil uses the personal loan money to pay the monthly ASB Financing instalments in the first year and the remaining balance is RM 16,000 – RM 14,452.80 = RM 1547.20 (This is the main secret of this ASB Financing technique).

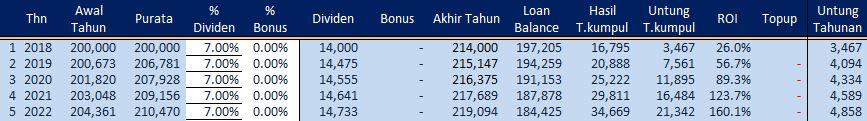

The ASB Financing instalment in the second year is paid by the ASB Financing dividend from the first year. Here is Mr Aidil’s ASB Financing return schedule.

In the 5th year, Aidil surrenders the ASB Financing certificate and his ASB Financing certificate balance is RM 219,094. His remaining ASB Financing debt with the bank is RM 184,425.

The profit he has gained is: RM 219,094 – RM 184,425 = RM 34,669. With just RM 294.66 per month and a total payment of RM 17,679.60, Mr Aidil gains a profit of RM 37,653. Isn’t this ASB Financing Technique interesting?