What is a Tenancy Agreement?

A tenancy agreement or rental agreement is a written rental contract agreed upon and signed by the landlord and tenant. This contract is mandatory during the rental process as it protects the rights of both the tenant and landlord throughout the rental period.

When this contract is written, its contents must be 100% understood by both the tenant and landlord. This is to avoid any issues arising in the future. Typically, this agreement is prepared by a registered lawyer or a real estate agent if the landlord uses the services of a real estate agent.

Once the tenant has placed a booking fee to rent the property, the landlord will appoint a registered lawyer or real estate agent to prepare a draft rental contract. This draft rental contract will be read by the landlord and tenant, and if there are any changes to be made, they will be done before the contract is signed.

Important Contents in a Tenancy Agreement

Typically, a tenancy agreement must include several mandatory items such as:

- Deposit amount

- Monthly rent amount

- Tenant landlord information

- Address of the rented premises

- No. Landlord’s bank account number

- House rental laws

- Monthly rent payment date

- Duration of the rental contract

- Responsibilities liabilities of the landlord tenant

- Inventory list of the house before it’s rented to the tenant

- Process of returning the deposit after the rental contract ends

- Conditions that cause the rental contract to be terminated

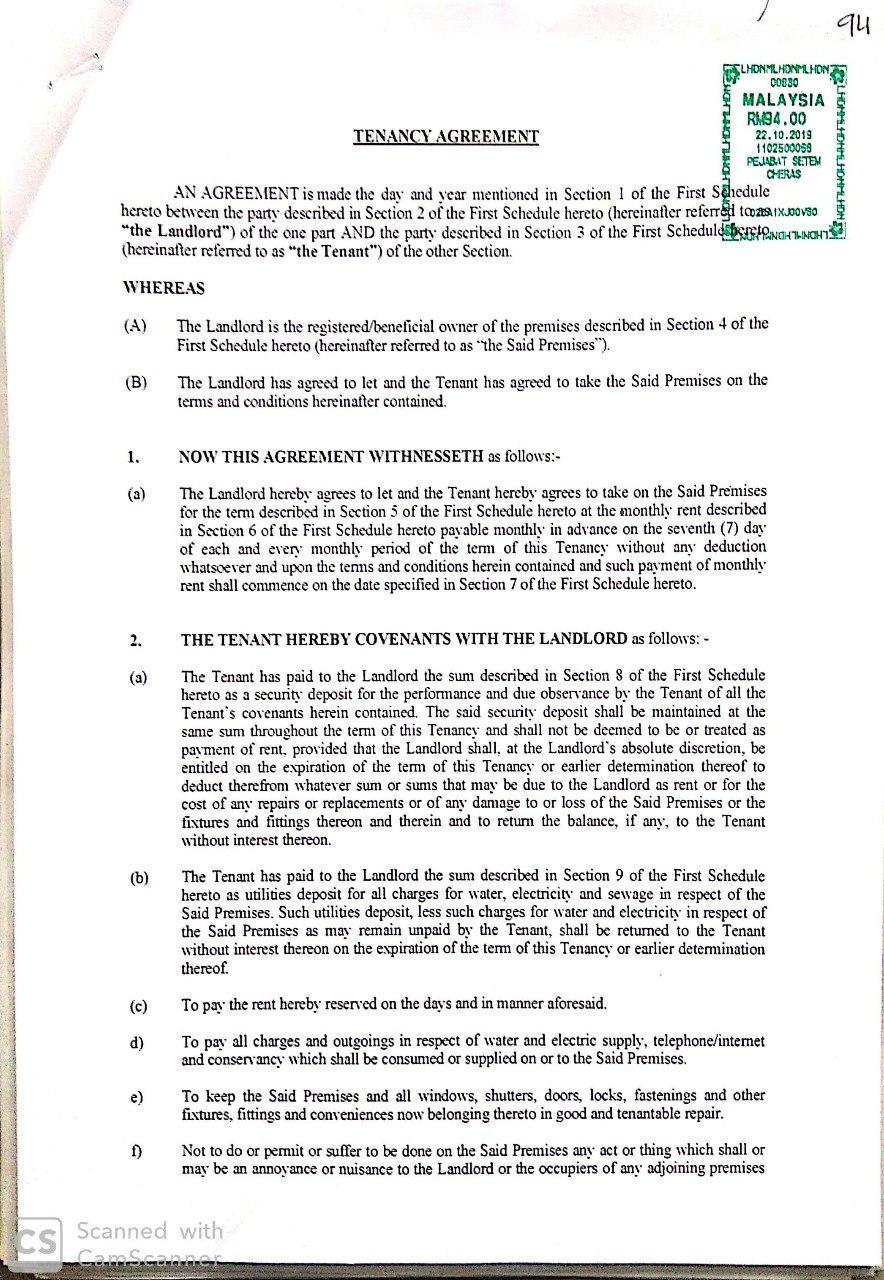

When this tenancy agreement contract has been agreed upon and signed, it will be taken to the Inland Revenue Board (LHDN) for stamp duty.

Stamp Duty Rates

Basically, for rental contracts of one year and below, the stamp duty rate is RM 1 for every RM 250 of annual rent exceeding RM 2,400.

For rental contracts exceeding 1 year but less than 2 years, the stamp duty rate is RM 2 for every RM 250 of annual rent exceeding RM 2,400.

For the second copy and subsequent copies, a charge of RM 10 per copy will be imposed.

For example, Aidil rents out his house at a rate of RM 1500 for a 1-year rental contract. He brings 1 main rental contract and 2 copy rental contracts to LHDN for stamp duty.

The calculation of stamp duty rates for Aidil’s house rental tenancy agreement is:

- Total annual rent

- RM 1500 x 12 months (1 year) = RM 18,000

- Annual Rent Minus RM 2400

- RM 18,000 – RM 2,400 = RM 15,600

- Stamp duty rate

- RM 15,600/250 X RM 1 = RM 62.40

- Charge for 2 copies of the rental contract

- RM 10 x 2 kontrak = RM 20

- Total amount to be paid to LHDN

- RM 62.40 + RM 20 = RM 82.40

When this tenancy agreement contract has been stamped, it is considered legally valid. Here is an image of a contract that has been stamped;

Advantages of a Tenancy Agreement for Landlords

A stamped tenancy agreement contract can be used as proof of additional income to the bank when the landlord wants to buy other investment properties. This contract needs to be submitted along with rent payment receipts and proof of rent payment from the tenant.

Bonus for You!

Get a free tenancy agreement draft contract from me! Click the button below to download.